Understanding the Basics of Home Improvement Loans

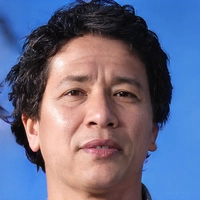

Hi there, folks! It's me, Landon, your friendly neighbourhood DIY guru. The other day my young daughter Naomi asked me, "Can you actually get a home improvement loan when you already have a mortgage?" Well, that question got me thinking and I felt, hey, there must be many more like Naomi, who are confused about this very topic. So, I decided to pen this article just for you! Now, before you start envisioning your renovated kitchen, let's dive into what a home improvement loan really is.

A home improvement loan is an unsecured personal loan that you can apply for to finance your home renovation needs. It can cover an array of expenses, ranging from a new roof to an entirely new bathroom or kitchen. Unlike a home equity loan or mortgage, this loan is not backed by your house - hence, your house is not at risk if you fail to repay it. However, like any other type of loan, there are prerequisites such as a good credit score, stable income source, etcetera.

Home Improvement Loans vs. Mortgage

So, the burning question - can one get a home improvement loan while having a mortgage? The answer is yes, of course! These two are different types of loans. Where a mortgage loan helps you buy a house, a home improvement loan aids in improving your existing property. They are structured differently, have different interest rates, and serve different purposes. However, managing two loans might be a little tricky, but it's nothing you can't handle with proper financial planning.

Remember when I wanted to add a playroom for Naomi and ended up applying for a home improvement loan? Well, that was while I was still paying off my mortgage. You need to ensure you are in a stable position to afford both bills.

Factors to Consider Before Applying for a Home Improvement Loan

Now just because you can get a home improvement loan while having a mortgage doesn't mean you should rush into it. There are several things that you need to consider before you proceed. First and foremost, you need to evaluate if the improvements are really necessary and the kind of return on investment they will provide.

Your credit score is crucial. Banks have stringent lending criteria and a delightful credit score can make the process smoother. Just like any wise man would, you should consider the associated costs, repayment terms, and most importantly, whether you can afford to pay both loans at the same time.

I can't stress enough on how important it is to do your homework before taking the plunge. You know how they say, "Rome wasn't built in a day?" Funny, but make of it what you will - it's about taking well thought-out steps. Your budget won't bloat overnight, but right moves can help manage it wisely.

Selecting the Right Home Improvement Loan

Figuring what type of home improvement loan works best for you is a big fish to fry. Some factors that could guide your decision include the amount of money you need, the urgency, the possible interest rates and your monthly budget. Not to mention, researching for good lenders who offer favorable terms is also important. Remember the time I painted my entire house green because I wanted to "feel nature"? Don’t make the same mistake.

While unsecured home improvement loans are a popular choice largely because they put no risk on your property, you might want to consider secured loans. They have lower interest rates as they are backed by collateral - usually your house. However, do remember the overriding risk of losing your home in case you default.

Navigating Through the Application Process

When you apply for a home improvement loan, you'll need to have some information at hand. Most lenders will ask for proof of income, credit score, and a detailed plan of your renovation project. Now, this is where I came in handy for Naomi. See, when you're planning a home improvement project, you need to be sure about what you want to do and what it will cost. This could include getting quotes from contractors, pricing materials and factoring in a contingency budget for any unexpected costs.

Managing Your Loans Wisely

Once your loan gets approved (woohoo!), next comes the daunting part - repayment. Now the idea of improving your home is to increase its value, not to burden yourself with a loan you can't afford. So, budgeting is key.

It's wise to set up automatic repayments to avoid missing any. I find it particularly helpful because, let's face it, we do forget things amidst our busy lives. Also, keep an eye out for opportunities to refinance either of your loans if interest rates drop. A lower interest rate will mean lower monthly payments and more savings in the long run.

Home Improvement Loans: The Final Verdict

So, drawing back to Naomi’s question and hopefully answering yours as well - yes, you absolutely can have a mortgage and a home improvement loan at the same time. How you manage them, however, that becomes your Perry Mason (a renowned detective, young folks!) now. Only take on what you comfortably can and use it to best improve your existing living quarters.

It's like that time I decided to build a treehouse for Naomi and halfway through realized I would need more materials and money than initially planned. That's when a home improvement loan came to my rescue. Home renovations can be unpredictable, but with careful planning and smart budgeting, you can make it a success and an enjoyable ride!

A Few Final Tips

In the financial jungle, getting a loan can sometimes feel a little overwhelming, but remember the kangaroo hops best when it needs to most. Take the leap, but beware of where you land. Always read the fine print, compare interest rates, and ask for advice when you need it.

Don't let the responsibility of having a mortgage deter you from upgrading your home. And amidst all, don't forget to enjoy the process of creating your dream home.